Insurance protection can be overwhelming, particularly for occupants who don't know that they need to safeguard their personal effects. What is tenants insurance coverage and why do you need it? Select ... Select . (What is umbrella insurance).. SUMMARY WHAT'S COVERED WAYS TO CONSERVE FAQ.

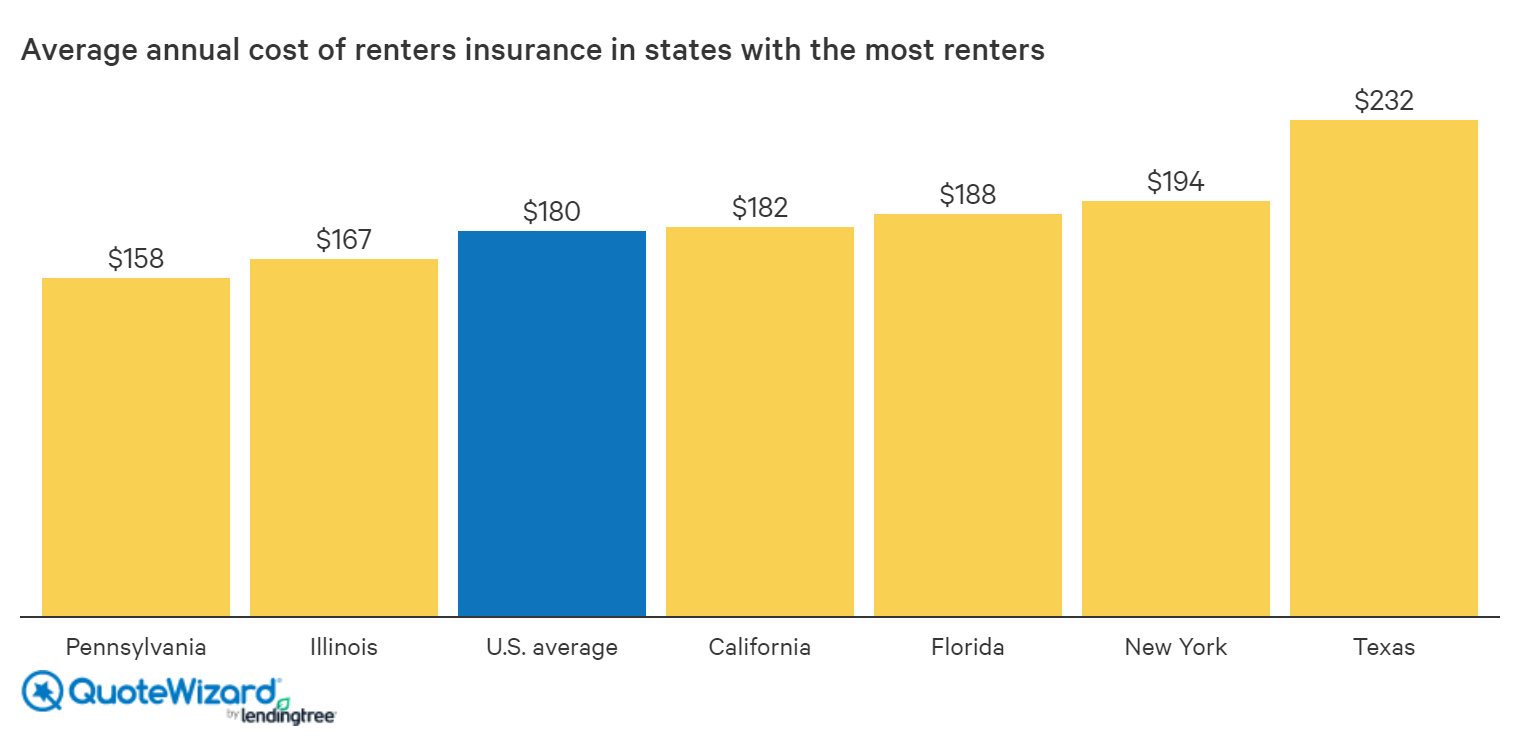

The average tenants insurance coverage expense in the U.S. is $168 per year, or about $14 per month, according to Geek, Wallet's most current rate analysis. This price quote is based on a policy for a theoretical 30-year-old renter with $30,000 in individual residential or commercial property coverage, $100,000 in liability protection and a $500 deductible. While the nationwide average is a helpful baseline, tenants insurance coverage rates can differ substantially based upon where you live and just how much coverage you require. The place of your wesley quote home is a significant consider the expense of your occupants insurance coverage. Check how much you can expect to spend for tenants insurance in your state listed below. If you live in the L.A. Basin or the Bay Area, you might end up handling a private insurance company for your regular renters insurance coverage needs, and the CEA for additional earthquake coverage. Prior to you verify your policy, thoroughly catalog your home's contents. You need to offer your insurance company with a rough accounting of these contents anyhow, but a more in-depth review is vital for your own records. Photo every item of worth that you own when your policy enters into result; to the level possible, save the purchase receipts for each product too. Do this for each huge purchase that you make after your policy goes into impact too.

It seems like overkill, however it's a relatively little investment that can significantly increase the probability that your claim will be accepted if you experience a loss. Whereas house owners with active home loans are usually required to guarantee their residential or commercial properties, occupants with active leases deal with no such required. Not remarkably, lots of occupants select to pass up tenants insurance coverage entirely - What is liability insurance. Rather of taking out different or bundled renters insurance coverage policies, they choose to develop an emergency fund sufficient to cover the expense of replacing their apartment or condo's contents. Is this strategy right for you? It depends. First, it is necessary to keep in mind that you can insulate yourself from specific types of danger particularly, liability for misfortunes that befall your visitors, maintenance employees, and your structure's other tenants without guaranteeing all of your personal effects.

Although it may be difficult for you to make the monetary case for bring material insurance coverage rather of keeping an adequate and well-managed emergency fund, it's more difficult to refute the advantages of fundamental liability protection on your apartment or condo. For starters, unprotected liability expenses can rapidly spiral out of control if an injured visitor needs to remain at the healthcare facility overnight, you're easily taking a look at a five-figure medical costs. Check out here No matter how close your relationship with the injured guest, you shouldn't depend on great graces to safeguard you from legal action. When it pertains to liability, friendly guests are the least of your worries.

Top Guidelines Of How Much Is A Covid Test Without Insurance

You'll likewise be liable to next-door neighbors who suffer property damage or injury as an outcome of a risk that originates within your apartment. Even if you carry liability coverage for 15 or 20 years prior to incurring a claim, you'll probably pay far less than you would to settle a legal conflict over simply one over night medical facility stay for which you're found responsible especially after representing legal charges. According to Insurance coverage. com, the nationwide typical expense of a tenants insurance policy covering liability and individual property with a coverage limit of $100,000 and a $1,000 deductible has to do with $27 each month, or $326 each year.

In more "dangerous" areas where adverse weather occasions prevail and criminal activity is greater, premiums can go beyond the average by 20% to 30%. When the alternative is a total loss of furnishings, clothes, and electronics with a cumulative worth of thousands or 10s of countless dollars, paying $326 each year or $3,260 over 10 years prior to inflation appears like a no-brainer. However, this heading figure is a bit deceptive due to aspects such as your policy's deductible and coverage limits. As you weigh the costs and advantages of acquiring content coverage, it's useful to break your options into these broad however distinct classifications:.

Premiums on these policies are far greater than the nationwide averages priced quote above, however the tradeoff for this expense is peace of mind. If you seem like you need a top-tier policy, you probably have some costly or rare belongings, and you might require to examine riders or additional insurance coverage to ensure that they're sufficiently covered. These policies feature low to moderate deductibles in between $300 and $500 and high coverage limitations (more than $50,000) - How to get renters insurance. They're particularly useful for families or middle-class couples who plan to rent for the long term; normal insurance policy holders have great deals of things to secure, but may not be able or happy to pay for top-tier coverage.

With larger deductibles in between $500 and $1,000 and lower protection limitations (between $20,000 and $50,000), these policies are popular with more youthful, upwardly mobile renters who make good earnings however have not yet accumulated lots of high-value possessions or began families. They work for securing electronic devices, clothing, and other important however not exceptionally valuable products. Offered the size of the deductible and the capacity for the cost of an overall loss to exceed the policy's protection limit, your middle-of-the-road policy must be combined with an emergency fund. Similar to " devastating" medical time share relief insurance policies, these instruments include high deductibles of $1,000 or more and fairly low protection limits (less than $20,000).